Applying for IPO (Initial Public Offering) from your Zerodha account is easy, but the initial setting-up process can be quite tricky. Once you get through that and connect your bank account to your Zerodha Demat account, applying for future IPOs will be quite easy.

There is no direct way to apply for IPO from Zerodha. You either need to submit a form offline or apply through internet banking. We recommend using the ‘net banking’ platform of your bank to apply for the IPO.

Almost all banks currently, including some of the major ones like ICICI Bank, Axis Bank, SBI Bank, HDFC Bank, IDBI Bank, Corporation Bank, Canara Bank – just to name a few – allow applying for IPO through their net banking platform.

[wpsm_ads1]

Here are the steps to apply for IPO from Zerodha:

- Login to your Zerodha account from the Q Back office link and enter your Client ID and Password.

- Click on profile and make note of the 8 digits under ‘Depository ID’ and 8 digits under ‘Beneficiary ID’. (Picture below)

- This 16 digit number is what we will be entering when we apply for the IPO through net banking.

Once that’s done, you need to login to your Net Banking. We will explain the steps using Axis Bank net banking.

- After you login to your net banking, you should be able to see ‘Investments’ menu somewhere. In ICICI Bank, you need to go to ‘Investments & Insurance’, then click ‘Invest Online’. In Axis Bank, hover your mouse over ‘Investments’, click ‘Online IPO’ and click ‘Register for ABSA’. In IDBI Bank, you click on ‘Investments’ and then click on ‘ASBA IPO Online’. The one-time process for registering to ABSA, should be similar for all other banks.

- Once you go that, you need to select the option ‘CDSL’ and in the ‘Beneficiary Number’ enter the 16-digit number that we got from Zerodha Back Office.

- Fill out other details like ‘Pan Card Number’, ‘Investor’s Name’, ‘Email ID’ etc.

The last step is to actually apply for the IPO and this step onwards is what you need to follow for all your future IPO investments:

- Login to your Net Banking (in our case Axis Bank), click on ‘Investments’ and then on ‘Online IPO’.

- You should now be able to see the IPOs that are currently available.

- At the time of this writing, Music Broadcast has just issued its IPO today (March 6), which we use for our example.

- Select your IPO and click ‘Initiate Payment’.

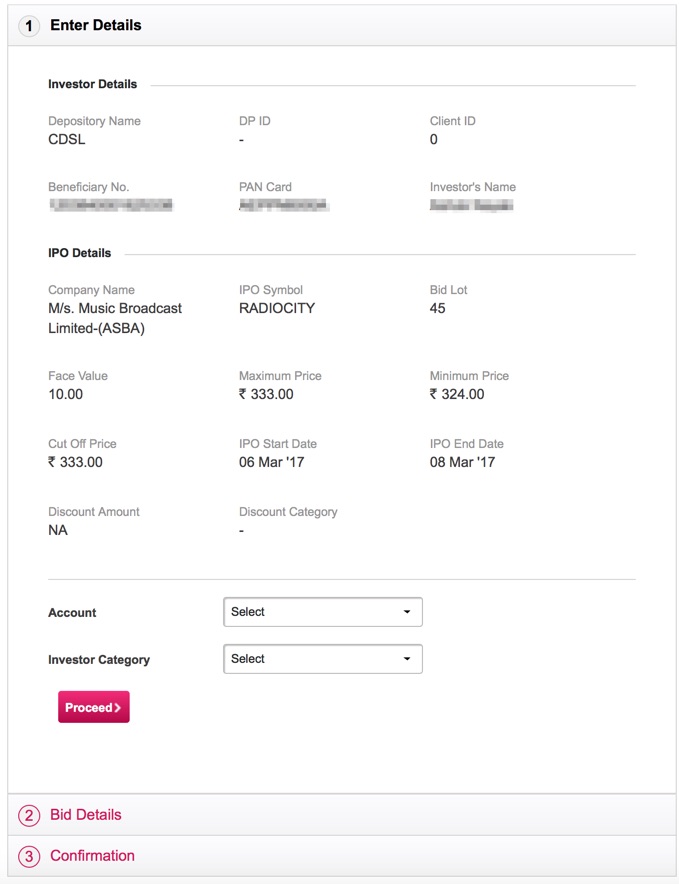

- All the details of the IPO should now be visible, verify the details. Then select your account number and Investor category (RIIs for Individuals).

- Click ‘Proceed’.

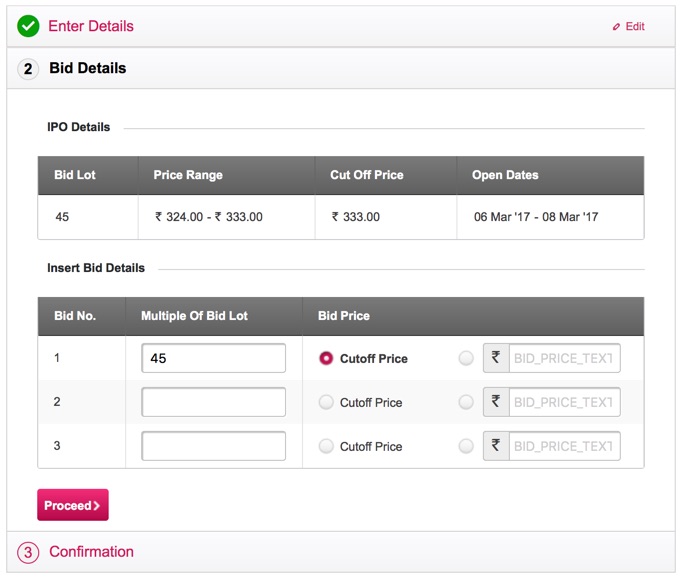

The last step is to enter the number of lots. If the ‘Big Lot’ is 45, then you enter 45 for one lot, 90 for two lots, 135 for three lots and so on. From our example, 45 share or one lot will deduct Rs 14,985 from your account. We recommend bidding at ‘Cut Off’ price or highest price range, for maximising your chances of atleast getting one lot of shares into your Zerodha Demat account.

On the listing day, which is usually a week after the last day of IPO, if you have been allotted the share you should receive an SMS on your registered mobile numbers and the shares should also be visible under ‘Holdings’ in your Zerodha.

If you have any questions, feel free to ask in the comments section below. We’d be glad to help.

I have a demat and trading account with zerodha. How i can buy ipo online through syndicate bank account

Hi, in Q Bakcoffice, i am not able to get any beneficiary id or any details, its totally blank.

Also when during the registration, i have select the CDSL option, and now i need to enter the Beneficiary Number,

so should i add beneficiary id given by q, or Demat id, or depository id?